A “Convoluted Mess of Nonsense”

A response to James Heartfield’s review of The Failure of Capitalist Production

Andrew Kliman

Platypus Review 73 | February 2015

I HAVE RELUCTANTLY DECIDED TO RESPOND to James Heartfield’s review (Platypus Review #70) of The Failure of Capitalist Production because more than a few people seem to think his review is a serious and interesting engagement with my book. I want to explain why it is not.

My task is made somewhat easier because I need not deal with the self-contradictory character of Heartfield’s review. Philip Cunliffe’s critique of it in the Platypus Review (#72) deals with that problem quite well. I will instead focus on empirical issues, because my book is principally a detailed analysis of data pertinent to an understanding of why the Great Recession erupted. (Although space constraints force me to disregard some of the review’s theoretical and empirical criticisms, I do not accept any of them.)

I agree with Brendan Cooney when he commented that the review is a “convoluted mess of nonsense” and that “Heartfield has misunderstood almost all of the main arguments of the book.” The chief thing he has misunderstood is that the book is a discussion of the “Underlying Causes of the Great Recession” (as its subtitle says)—which is a topic almost entirely absent from Heartfield’s review—rather than a part of what he calls “the extensive literature on American decline.” (( See James Heartfield, “The failure of the capitalist class and the retreat from production,” Platypus Review #70 (October 2014). Available online at: http://platypus1917.org/2014/10/26/the-failure-of-the-capitalist-class-and-the-retreat-from-production. ))

My main aim, however, is not to complain about Heartfield’s review per se, but to protest against the fact that the debate over the causes of the Great Recession has in general failed to adhere to proper intellectual standards. To take just one of many other examples, the geographer David Harvey recently published a draft paper which takes issue with the “single causal theory of crisis formation [that] many Marxist economists like to assert.” He alleges that “Andrew Kliman has been most strident in his claim that the crisis (the crash of 2007–8) had nothing to do with financialization.” (( David Harvey, “Debating Marx’s Crisis Theory and the Falling Rate of Profit.” Available online at: http://davidharvey.org/2014/12/debating-marxs-crisis-theory-falling-rate-profit/ )) But he provides no evidence that I have ever made such a preposterous claim, stridently or otherwise, and my book (which he cites) explicitly says the opposite: “a financial crisis triggered the recession, and phenomena specific to the financial sector (excessive leverage, risky mortgage lending, and so on) were among its important causes.” (( Andrew Kliman, The Failure of Capitalist Production: Underlying Causes of the Great Recession (London: Pluto Books), 2012, p. 6. ))

I think Anatole France was correct. The “majestic equality” of laws which “forbid the rich as well as the poor to sleep under bridges, to beg in the streets, and to steal bread” is actually a parody of equality. By the same token, a process which allows a more dominant school of thought to level a host of egregiously incorrect criticisms against a less dominant one, and “allows” the latter school to devote much, if not most, of its limited time and resources to defensively replying to this host of unfounded criticisms, is actually a parody of pluralism and scholarly dialogue.

This is not a case of an “aggrieved author” taking umbrage at “bad reviews.” The chief victim of the failure to adhere to proper intellectual standards is the public. A process in which the protagonists say what they want, while the reader bears the burden of sorting it all out, is a woefully inadequate method for getting at the truth. Left to their own resources, readers generally lack the expertise—and especially the time needed to gain the expertise––to separate fact from fiction, sound argumentation from appealing storytelling. They need the assistance of publishers, editors, and the scholarly community at large. But they aren’t getting it. Thus, the public is left unprotected against manipulation and the pull of preconceptions and dominant discourses. It needs to register its protest, too; otherwise the problem will persist and probably get worse.

The “Productivity/Compensation Gap”

Heartfield’s key empirical claim is that “wages … stagnated while productivity climbed” in the U.S. from the early 1980s onward, and that this means there was a “fall in the workers’ share of output.” For added effect, the review reproduces a scary-looking graph, a variant of the so-called “productivity-compensation gap.” However, as I have explained elsewhere, that gap and variants of it are just extremely misleading factoids that are produced by researchers who adjust for inflation in an inconsistent manner. (( Andrew Kliman, “Were Top Corporate Executives Really Hogging Workers’ Wages?” Truthdig, September 18, 2014. Available online at: http://www.truthdig.com/report/item/were_top_corporate_executives_really_hogging_workers_wages_20140917. )) They do not mean that workers’ share fell, contrary what has been claimed by Doug Henwood, the “authority” to whom Heartfield appeals. (( Doug Henwood, “A Return to a World Marx Would Have Known” New York Times, March 30, 2014. Available online at: http://www.nytimes.com/roomfordebate/2014/03/30/was-marx-right/a-return-to-a-world-marx-would-have-known. )) To draw that conclusion is to “lie with statistics.”

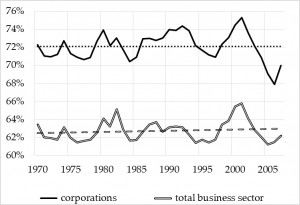

Figure 1 shows the trend, or more precisely, the lack of any trend, in employee compensation as a share of output (net value added) in the U.S. corporate and total business sectors between 1970 and 2007. The employee-compensation and output data come directly from the U.S. government, without any adjustment. (The “net” in “net value added” means “after depreciation”; depreciation is excluded because, as Dean Baker puts it, “[n]o one eats depreciation,” neither workers nor business owners.) (( “Wages as a Share of Net Output, not Gross.” Center for Economic and Policy Research, September 14, 3013. Available online at: http://www.cepr.net/index.php/blogs/beat-the-press/wages-as-a-share-of-net-output-not-gross. ))

Figure 1. Employee Compensation as Share of Net Output, U.S. Corporate and Business Sectors

Although compensation of employees includes the pay of CEOs and other top corporate executives—most of which is arguably profit in disguise—makes extremely little difference. I have estimated that rising compensation of executives in “the 1%” depressed other employees’ share of business-sector output by only 0.6 percentage points between 1979 and 2005. Even a wildly unrealistic assumption about the growth in the executives’ pay relative to the growth of their total income results in a decline of less than one percentage point. (( Kliman, “Were Top Corporate Executives Really Hogging Workers’ Wages?” ))

So much for the mythical fall in workers’ share of output.

But what about the supposed fact that compensation received by employees has failed to keep pace with their productivity? Well, the fact that the compensation share did not trend downward means that compensation and output rose at the same rate, which in turn means that compensation per hour of work and output per hour of work rose at the same rate. But “productivity” is just another word for output per hour of work. So hourly compensation and productivity rose at the same rate. The gap did not increase.

That is the case when we use the plain dollar figures, as I have done here, and it is also the case when we adjust for inflation in a consistent manner. The supposed increase in the “productivity/compensation gap” results from inconsistent inflation-adjustment; one price index is used to “deflate” the productivity figures but a different price index is used to “deflate” the compensation figures.

Imagine that output is originally $100 and workers get $60. In some later year, output is $300 and workers get $180. The workers’ share is 60% in both cases; it does not fall. Yet if we take the latter year’s numbers and deflate (divide) output by a price index that has doubled but deflate compensation by a different price index that has tripled, we get $300/2 = $150, and $180/3 = $60. Voila! We have created a “productivity/compensation gap” that the Henwoods and Heartfields can use to tell us that the workers’ share fell from 60% to 40% ($60/$150).

Following my exposé of this “gap,” my editor at Truthdig contacted several left or liberal critics of my work. None of them identified any error in my analysis, but none of them were willing to speak on the record! Such is the left wing of capital’s attitude to getting at the truth.

Unfounded Accusations of Misconduct

The really disgusting aspect of Heartfield’s review consists of his unfounded accusations that I am guilty of grossly unethical manipulation of data. He claims that I have “doctor[ed] the figures on pay” and have “massage[d] the statistics on the rate of profit” in order to “to make it look smaller.” Given that these allegations are not accompanied by any evidence, the Platypus Review should not have allowed them to be published.

I did not “massage” statistics on the rate of profit. The government does not publish any rate-of-profit statistics. So there is no pre-existing data series that I cleverly “massaged” or “adjusted” Everyone who produces a data series that they call a “rate of profit” has constructed this ratio, using other data series (on profit, capital, etc.). The U.S. government does not say which way the rate of profit should be constructed; “rate of profit” is just not one of its national accounting concepts.

And while Heartfield claims that “one cannot help but think that the real importance of the adjustment that Kliman makes to the rate of profit is to make it look smaller,” there certainly is a way to avoid thinking such a terrible thing. One could have believed me when I wrote that “I knew that proponents of the conventional [Left] wisdom mis-measure the rate of profit” before doing my empirical research, “but I had no reason to believe that their measures were overstating the rise in profitability instead of understating it.” (( Kliman, The Failure of Capitalist Production, pp. 5–6. )) In other words, I had no reason to think that the trajectory of the “massaged” (i.e., correctly measured) rate of profit would contradict rather than reinforce their claims.

If I am guilty of “doctoring” the figures on pay, then so is the U.S. government’s Bureau of Economic Analysis (BEA) and so are the national accounting agencies of all of the other governments that follow the standards laid out in the international System of National Accounts (SNA). The figures for employee compensation I used came directly from the BEA. I did not “doctor” or adjust them in any way, and I did not concoct my own “expanded definition of wages.” Heartfield may not like the fact that “the inflated cost of health insurance and other elements of the so-called ‘social wage’” (e.g., the portion of Social Security benefits paid for by a tax on employers) are parts of employee compensation, but the SNA and the BEA say that they are.

And they are correct. One may think that a dollar of health-insurance benefits, or a dollar of Social Security benefits, fails to provide employees with as much subjective utility as a dollar of cash wages received immediately, but that is irrelevant. The purpose of the national accounts is to track where the dollars go, not to measure utility. The dollars in question go from employers to employees. That is, an extra dollar that a company spends on “inflated … health insurance,” or an extra dollar that it pays in Social Security tax, reduces its profit by a whole dollar, just as an extra dollar of cash wages does! It is not really profit. The people who “doctor the figures on pay” are those who exclude the benefits component of employee compensation in order to wrongly make it seem as if the slow growth of cash wages received immediately means that workers’ pay has stagnated. Workers are paid health-insurance benefits and Social Security benefits funded by the tax on employers.

Value and Exploitation

Heartfield devotes almost a thousand words to a discussion of the temporal single-system interpretation (TSSI) of Marx’s value theory. The whole thing is just a display of fake erudition. He literally has no idea what he is talking about.

According to Heartfield, a “long-defunct[!] school of ‘neo-Ricardians’” tried to solve the alleged inconsistency in Marx’s theory “using a ‘single-system interpretation,’” according to which “there was no ‘transformation’ of values into prices, but that all values are already prices.” Even worse, he claims that TSSI supposedly tries to explain the fact that “inputs are not equal to outputs.” He claims that the TSSI attributes this inequality to “depreciation of capital goods” and the fact that “the value of the goods that make up the production process [sic] changes over time in the production process.” According to the review, the TSSI thereby “demotes exploitation as the main difference in the value of inputs and outputs.” (This is a reference to the fact that, in Marx’s theory, workers’ surplus labor is the sole source of the surplus-value that causes the total value of output to exceed the total capital that was advanced to produce it.)

All this would be side-splittingly funny if it were in an F-minus freshman essay. But it was deemed worthy of publication in the Platypus Review; and a goodly number of people seem to think that Heartfield’s review is a serious and interesting response to my book. This is just a sad sign of the decrepit state of Marxist thought today—especially insofar as the critique of political economy is concerned. (I doubt that the Platypus Review would publish a piece that mistook Adorno for a brand of hair spray; Heartfield’s errors here are hardly less elementary.)

When the TSSI says that the values of inputs and outputs can differ in Marx’s theory, it is referring to per-unit values. For example, the value of a pound of coal used as an input into the production process can differ from the value of a pound of coal that emerges as an output of the process. This has nothing to do with what causes the total value of output to exceed the total value of inputs. Thus, the TSSI neither contradicts nor “demotes” Marx’s exploitation theory of profit. In fact, the TSSI is the only interpretation that preserves this crucial facet of Marx’s theory. All simultaneist (atemporal) interpretations actually imply that surplus labor is not the exclusive source of profit, as Roberto Veneziani was forced to concede in a 2004 paper in Metroeconomica (the flagship journal of the “long-defunct school of ‘neo-Ricardians’”). (( Roberto Veneziani, “The Temporal Single-system Interpretation of Marx's Economics: A Critical Evaluation,” Metroeconomica vol. 55, no. 1, pp. 96–114. ))

Investment

Heartfield claims that we now have a “risk-averse capitalist class.” In light of the frenzied speculation that culminated in the biggest financial crisis since 1929, this is simply preposterous. He tries to dig himself out of the contradiction between the facts and his theory by claiming that what I regard as “a sign of excessive risk-taking is in fact a symptom of risk aversion.” This may seem like sophisticated dialectic, but it is equally preposterous. He swallows whole the Federal Reserve’s self-serving “saving glut” explanation of the U.S. home-price bubble, ignoring the facts that saving did not exceed productive investment globally and that, in the U.S., productive investment substantially exceeded domestic saving. (( Kliman, The Failure of Capitalist Production, pp. 44-5. Note also that neoliberalism and financialization did not cause productive investment to fall, or financial payments and acquisitions to rise, as shares of U.S. corporations’ profits (see Andrew Kliman and Shannon D. Williams, “Why ‘financialisation’ hasn’t depressed US productive investment,” Cambridge Journal of Economics, 2014. Available online at: http://cje.oxfordjournals.org/content/early/2014/09/23/cje.beu033). )) No risk-averse behavior there. But even if there had been a saving glut, no one forced anyone to speculate in risky mortgage-related securities instead of parking savings in T-bills, money-market accounts, and under mattresses. A “risk-averse capitalist class” would have done the latter. It’s that simple.

Heartfield contends that “Kliman…claims that what is important is not the cost it would take to replace the capitalists’ assets but their historical cost. But capitalists use different ways of reckoning their investments in different circumstances; sometimes one way, sometimes another.” This is not correct. Capitalist firms use different ways of reckoning the value of their assets. The assets’ replacement cost is indeed one way to value them. But investment (the advance of capital) is an entirely different matter. Imagine that a company spent $100,000 on a computer system ten years ago, and imagine that the exact same system could be replaced for only $2000 today (not that any company would want to do such a thing). It is certainly legitimate to say that the current value of the company’s existing computer system is $2000 (assuming that it has suffered no wear & tear). But it is completely illegitimate to say that the company invested $2000 when it acquired the computer system ten years ago. It invested—forked over—$100,000.

And this brings us to the “dirty little secret” of the rising-rate-of-profit camp. When it tells us that U.S. corporations’ “rate of profit” substantially rebounded under neoliberalism, from the early 1980s until the Great Recession, it is not actually telling us that there was a sustained rise in the corporations’ rate of return on investment, i.e., their profit as a percentage of the amount of money they forked over to acquire their assets. The facts are clear. There was no such sustained rise. What the rising-rate-of-profit camp is actually telling us is that there was a rise in profit as a percentage of the amount of money that the corporations would need in order to replace all of their assets today. So what? It has never been made clear why this matters or whether it matters. I do not think it does.

“Good” and “Bad” Capitalists?

Heartfield reproduces a graph that depicts a decline in work stoppages. He claims that it “shows that the ruling class substantially defeated the challenge of organized labor in the 1980s.” Actually, the graph shows that the number of work stoppages began to fall long before the 1980s. There were 412 stoppages in 1969. By 1980, there were only 187. Thus, well more than half of the total fall in work stoppages between 1969 and today occurred before the supposedly watershed event—the smashing of PATCO (the Professional Air Traffic Controllers Organization) by the Reagan administration in 1981.

Heartfield’s error is no accident. An entire chapter of my book is devoted to exposing a wide variety of similar errors—i.e., attempts to postdate to the 1980s economic changes that actually began in the 1970s or earlier. In every case, the effect of the postdating is to wrongly make it seem that the turning point in recent U.S. economic history was the 1980s, when the “bad” (neoliberal) wing of capital beat out the “good” (Keynesian-statist) wing and supposedly ushered in a long-run expansionary phase of capitalism on the backs of the working class. (Heartfield even has the audacity to refer to “the recovery of capitalist growth in … the first [decade] of the twenty-first [century],” as if the Great Recession never occurred.) And this story enables the Left to console itself with the idea that its isolation and irrelevancy are due to the alleged smashing of the working class rather than to its own errors, attitudes, theories, and so on.

Theory and Empirical Evidence

Heartfield writes, “What in Marx is an expression of the accumulation process [i.e., the tendency of the rate of profit to fall] becomes the primary driver, in Kliman’s theory, which claims that the falling rate of profit ‘produced a persistent fall in the rate of capital accumulation.’” This is ridiculous, for two reasons. One reason is that what he calls “Kliman’s theory” is not theory at all. It is an empirical finding. It cannot be dismissed by counterposing it to “another” theory that one prefers. Heartfield does nothing to call the finding into question.

The other reason is that Heartfield’s understanding of Marx’s theory of capitalist accumulation is abysmally poor. Marx clearly argued that “the rate of profit [is] the stimulating principle of capitalist production, the fundamental premise and driving force of accumulation,” that “the rate of accumulation falls with the rate of profit,” that “the accumulation of capital in terms of value is slowed down by the falling rate of profit,” etc. (( Karl Marx, Capital Volume III, Ch. 15. Available online at: https://www.marxists.org/archive/marx/works/1894-c3/ch15.htm. )) There is nothing inconsistent about claiming that capital accumulation that has a labor-saving bias produces a tendency for the rate of profit to fall, but that the fall in the rate of profit in turn tends to retard capital accumulation. This isn’t even remotely paradoxical. Heartfield wants us to have to choose between these two claims, but we don’t have to. Marx was describing what is now called a “negative feedback loop,” in which the initial stimulus produces a reaction that in turn lessens the stimulus. For another example, consider a fall in temperature that triggers a thermostat to switch the heat source on, which in turn raises the temperature. If the process Marx described is inconsistent, then so is a thermostat.

Heartfield writes, “That increased productivity, by cheapening the means of subsistence, makes it possible for capitalists to pay their workers less and increase exploitation, which was so central to Marx’s theory, does not feature in Kliman’s.” Here again, we have an empirical finding wrongly characterized as theory in order to improperly dismiss it by counterposing it to “another” theory that one prefers. And here again, Heartfield gets Marx’s theory wrong. Neither in reality nor in Marx’s theory is there any automatic cause-and-effect relation between the cost of reproducing workers’ ability to work (labor-power) and the wages and benefits they receive. The cost of reproducing workers’ ability to work is one thing that influences how much they are paid, but certainly not the only thing. For instance, Marx argued that, “Apart from violent conflicts as to the rate of wages … a rise in the price of labour resulting from accumulation of capital implies” either that “the price of labour keeps on rising, because its rise does not interfere with the progress of accumulation” or that “accumulation slackens in consequence of the rise in the price of labour, because the stimulus of gain is blunted.” (( Karl Marx, Capital Volume I, Ch. 25. Available online at: https://www.marxists.org/archive/marx/works/1867-c1/ch25.htm. )) If the process of capital accumulation and “violent conflicts” affect wage rates, then the cost of reproducing workers’ ability to work is clearly not the sole determinant.

Conclusion

Heartfield’s misrepresentation of these empirical findings as theoretical claims is connected to the fundamental problem of his review. He wants to depict me as having told a story that he can oppose by telling a different story and by pointing to distortions in mine. Thus, his review is chock-full of complaints that I put too much stress on one thing but too little on another; that I ignore certain alleged facts and dismiss others; that I underestimate this, fail to understand that, and miss out the other.

But my book is actually a detailed analysis of data, not a story. This does not mean that I necessarily got everything right; I may have made computational and interpretive errors. (I may also have looked at the wrong phenomena, but the phenomena I looked at are those that my opponents look at; I argued that they misunderstand these phenomena, not that they should have looked at other ones.) Yet the fact that my book is a detailed analysis of data rather than a story does mean that Heartfield’s “stress-related” criticisms are completely irrelevant. For example, I found that U.S. corporations’ rate of profit fell and never recovered in a sustained manner under neoliberalism. This finding cannot properly be challenged by pointing to factors which affect the rate of profit that I failed to stress, ignored, or whatever—because there are no such factors! The trajectory of the rate of profit was the net result of everything that affected the rate of profit, that is, everything that affected profit and everything that affected capital investment—all tendencies, countertendencies, institutions, accidents, etc.

Thus, irrespective of how much or how little a particular factor was explicitly discussed in my book, its influence was fully taken into account because the data reflect its influence. The net result of the operation of all of these factors was that the rate of profit fell and never rebounded in a sustained manner. |P