The failure of the capitalist class and the retreat from production

James Heartfield

Platypus Review 70 | October 2014

Book Review: Andrew Kliman, The Failure of Capitalist Production: Underlying Causes of the Great Recession.

London: Pluto Press, 2012.

WRITTEN IN THE AFTERMATH of the 2008 banking crash and published in 2012, Andrew Kliman’s The Failure of Capitalist Production adds to the extensive literature on American decline.[1] Kliman identifies the way that profits have tended to fall relative to investments since the 1970s and also the diminishing rate of investment itself (the latter, he says, a consequence of the former)—a period of underaccumulation over the period from the mid-seventies to the present day, around 40 years, or longer than most people have been alive. Claiming to ground his argument in Marx’s theory of capital, Kliman says that “the persistent fall in the rate of profit produced a persistent fall in the rate of capital accumulation” (p 74).

Kliman’s reading of Marx, though, is questionable. Marx’s theory of capital accumulation was not a theory of decline, but of dynamism. In Marx’s theory the rate of profit (s/c+v in Marx’s notation) is a superficial expression of the more fundamental rate of exploitation, the difference between the value that the worker produces in the production process and the capital advanced (as wages) to secure his labor power—both at the level of the individual firm, and by extrapolation, across the whole economy.

The surplus value created is the source of the capitalist’s wealth and the fund from which he makes new investments, leading to the accumulation of capital. The part of Marx’s theory that Kliman appeals to is the later, third book of Capital, in which Marx shows the limitations of capitalist dynamism. Over time capitalists invest more in the technical means of production (such as machinery, raw materials, plant—represented as ‘c’, in Marx’s formula, standing for ‘constant capital’) and relatively less on labor power (‘v’, in Marx’s formula, standing for ‘variable capital’)—though labor is the real source of all surplus value. As the non-value creating ‘c’ takes a greater share in the capital advanced relative to the value-creating ‘v’, the surplus ‘s’ though increasing, diminishes relative to the total capital advanced. In that way a greater surplus value (s/v) can still give rise to a smaller rate of profit (s/c+v).

Kliman puts much stress on the account of the capitalist limits to growth that Marx sets out in his third book, but too little on Marx’s claim that these limits arise out of the dynamic drive to extract surplus value and accumulate capital in Volume 1. Whereas Marx sets out a theory of capitalist overaccumulation, Kliman finds fault with capitalist underaccumulation.

Whether Kliman’s is a good rehearsal of Marxist theory is one question, but perhaps more pressing is whether it is a good account of the dynamic of the economy today. The book’s shortfall here is that it sets out to assimilate contemporary empirical evidence to ideas and patterns derived from the past. ‘Capitalism has changed far less than people like to think’ he says (21). That is a formula that leads Kliman to look away from what has changed—first, to ignore the consequences of the defeat of organized labor and the left for the stabilization of capitalism in the 1990s, and second, to underestimate the extent of the demoralization of the capitalist class in that settlement.

Ignoring the defeats of the working class in the eighties…

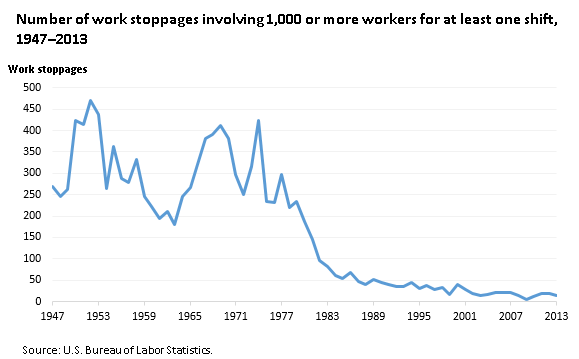

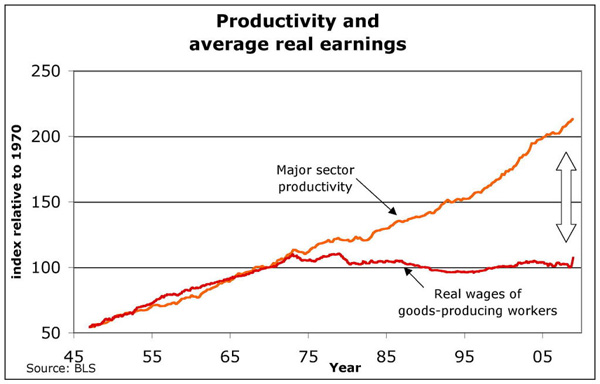

The marked decline in strikes shows that the ruling class substantially defeated the challenge of organized labor in the 1980s. The ability of the working class to defend itself had a direct impact on wages, which stagnated while productivity climbed.

Kliman rubbishes the extensive evidence that capitalists did indeed appropriate much more surplus value through the revolution in labor relations in the 1980s. He scoffs at those like Doug Henwood who point to the fall in the workers’ share of output as the basis of a renewed capitalist expansion (72). The boom was “artificial” (73). Kliman doctors the figures on pay by adding in the inflated cost of health insurance and other elements of the so-called “social wage”, to try to diminish the importance of the rate of exploitation (it is only a surprise that he does not include the cost of America’s prison system in his expanded definition of wages) . It is a curious by-product of Kliman’s doctrine of decline that he wants to make light of the increased exploitation of the workers.

Because Kliman only deals in the ratios between wages, profits and investment, he misses out a singular change that did take place between 1983 and 2007, which is that the absolute number of US workers increased from 99 million to 145 million. Even if he was right that there was no increase in the rate of exploitation, the system grew to embrace an additional 46 million workers into it, generating a much greater mass of surplus value. That expansion was made possible by the defeat of organized labor, and the low level of wages, which meant that businesses could grow by hiring at reduced costs.

Though he deals mainly with America, Kliman claims that his insistence that “Capitalism has changed far less than people like to think” is true worldwide. He posts figures to show that the world’s output grew faster in the 1970s than it does today (52-3). Those numbers do show a dynamism in the earlier period in the economies of Western Europe, the U.S., and Japan. But they also include some very dubious growth drawn up by Khrushchev and Mao’s statisticians trumpeting breakneck growth in Soviet Russia and Communist China. Today most people would understand that much of this “growth” was fraudulent, and none of it was evidence of capitalist dynamism—most people apart from those few like Andrew Kliman, who hold to the view that the Union of Soviet Socialist Republics and the People’s Republic of China were actually capitalist societies, cunningly disguised.

Kliman’s claim that the communist states were really capitalist states matters because it leads him to dismiss the second most important change in class relations after the defeat of organized labor: the market reforms in the collapsed Stalinist regimes in Eastern Europe and Russia and in China and Vietnam have created a vast new pool of surplus value for capitalism. Between 1978 and 2010 the share of China’s workforce in industry grew from 10 to 30 percent, and the value they added grew seven times. In Russia, too, after a rough beginning, capitalism is doing pretty well. Workforce participation is growing, and the share of private sector industry in employment is higher than in Western Europe. The European Union has greatly expanded its sources of labor by the exploitation of millions of additional workers in East Germany, Poland, Bulgaria and the other “Accession Countries”. All of that capitalist expansion adds to America’s capitalist expansion, as these growing markets buy US industrial goods, while selling them cheaper consumer goods.

To Kliman none of these changes amount to very much, though in fact they are largely the reason that the capitalist class managed to avoid the consequences of falling profitability in the seventies and eighties. And though he denies it really happened, these reforms are the basis of the recovery of capitalist growth in the last decade of the twentieth century and the first of the twenty-first.

…but also underestimating the limits to accumulation today.

Kliman underestimates the extent of the defeat of the working class and the way that made it possible for the capitalist class to recover from the economic crises in the 1970s. But ironically he goes on to underestimate the limits to accumulation in the more recent period up to today. For Kliman the limits to growth remain principally economic limits: the disappointing returns on capital dissuade investors.

But what he fails to understand is the destructive impact of the settlement of the class conflict in the preceding period for the ruling class. The costs that they paid in stabilizing the system were profound. To defeat the working class challenge of the seventies, the elite tore up the old institutions that bound the masses to the state. Class conflict was institutionalized under the old system, which not only contained working class opposition but also helped the ruling class to formulate a common outlook.

What started as an offensive against working class solidarity in the eighties undermined the institutions that bound society together. Not just trade unions and socialist parties were undermined, but so too were right-wing political parties and their traditional support bases amongst church and farmers’ groups. Middle class professional groups lost their privileged position. And that class that fought so hard to establish its rule, the capitalist class, is unexpectedly cautious about driving society forwards. Today’s capitalist elite barely act as an elite at all, but recoil from their historic justification as agents of growth.

Kliman inherits a view of the capitalist class as driven by gain, but limited by economic restraints. But that hardly obtains today. Today’s capitalists have internalized the sense of limits, as a raft of anti-growth sentiments that are motivated in terms of ecology, Corporate Social Responsibility and safety-consciousness.[2] The effect is a risk-averse capitalist class that are unwilling to make decisions that threaten social change.[3] The historic role of the entrepreneur revolutionizing the means of production simply does not operate. These are the new social conditions that Kliman misses because he is trying to subordinate what is new to the old model he has received from the past.

The question of how the rate of profit could act as a barrier to capital accumulation is hardly posed, since today’s capitalists are simply not interested in taking the risks that would test those limits. Kliman takes the opposite view. To him it appears that there is “excessive risk taking” and that flippant investors do not “anxiously weigh” the decisions in the way that the old family firm would (19). But what he takes to be a sign of excessive risk-taking is in fact a symptom of risk aversion. Low rates of investment on the part of cautious capitalists are the reason for the glut of capital that has fuelled a series of financial bubbles: the Asian financial crisis of 1997 and the Russian investment bubble the following year, the 2001 dot-com boom, through to the 2008 sub-prime mortgage bubble.

Kliman objectifies the barriers to capital accumulation, treating the relations between, ossified into algebraic terms, as if they were physical ratios that were being measured. It is a point of view that mirrors, rather than challenges, the outlook of low growth. His miserablist account of the possibilities of growth chimes with the anti-growth sentiments of the capitalist class.

A flawed methodology

Kliman’s book is based on an interpretation of US government statistics on the economy, through which he claims to prove that Marx’s theory of the tendency of the rate of profit to fall is a good one. He is not the first to do so. Michel Aglietta (A Theory of Capitalist Regulation: The US Experience, 1976), Dumenil and Levy (The Crisis of Neo-Liberalism, 2013), Anwar Shaikh (Measuring the Wealth of Nations, 1994, with E Ahmet Tonak), Joseph Gillman (The Falling Rate of Profit, 1958) have all published accounts of falling rates of return on US business investments claiming that these prove Marx’s theory. But Marx’s theory does not need to be ‘proved’. It is a logical reconstruction of capital accumulation. “For some of his disciples the ‘law of value’ … seems to assure the breakdown of capitalism”, chided Paul Mattick, adding: “Marx’s critique of political economy became the ideology of the inevitability of socialism.”[4]

Moreover, the tendency of the rate of profit to fall is not a separate part of Marx’s theory of accumulation—though Kliman fetishizes it as such. Marx says the tendency of the rate of profit to fall arises out of the “continual relative decrease of the variable capital vis-à-vis the constant and consequently the capital”, which is, “identical with the rising organic composition of capital” (the greater share taken by c to v in the formula, reflecting the technical growth of technology to men). What is more “it is likewise just another expression for the progressive development of the social productivity of labor”. “The progressive tendency of the general rate of profit to fall is, therefore, just an expression, peculiar to the capitalist mode of production of the progressive development of social labor,” says Marx.[5] What in Marx is an expression of the accumulation process becomes the primary driver, in Kliman’s theory, which claims that the falling rate of profit “produced a persistent fall in the rate of capital accumulation”.

Kliman misses out the relation between the rising organic composition of capital and the falling rate of profit. He does not even think that business investment has any great impact on the productivity of labor. He quotes Marx to the effect that new technology creates no new value—but he misses out the argument in Marx that by cheapening the means of consumption new technologies mean employers can pay relatively less out in wages, and keep more of the value created for themselves.

Kliman separates out the falling rate of profit from its origins in accumulation, enthroning it as sovereign over all else. That the falling rate of profit in Marx is coeval with the progressive development of social labor is lost on Kliman. His statistical account of the empirical rate of profit serves to sever it from the logical account of its origins.

Kliman would have been wise to listen to Raya Dunayavskeya, who said, “once you understand the law of surplus value, the law of profit would present no difficulty; if you reversed the process, you could understand neither the one nor the other”.[6]

Indeed he goes so far as to claim that the rate of accumulation “tracks” the movement of the rate of profit—which would be interesting, but most definitely a disproof of Marx’s theoretical account in which, vice versa, the movement in rate of profit is an expression of the accumulation process.

But there is nothing in itself revolutionary about the insight that profits tend to fall. This much was already well-known by economists, who called it the law of diminishing returns. Noticing that in the ordinary process of capitalist growth there is also a tendency for the rate of profit to fall had no revolutionary consequences.

Capital depreciation as the motor of history?

Kliman’s own school in economic theory is known as the “Temporal Single System Interpretation” (or TSSI). This peculiar backwater is a debate over an alleged inconsistency in Marx’s theory of accumulation. Marx said that if it were the case that profits had their source in labor alone, then businesses that were labor-intensive would get higher profits than those that were capital-intensive. Plainly the theory should be amended. According to Marx, the rate of surplus value is as he analyzed it for the economy as a whole, but that individual businesses drew a rate of profit from the collective pool of surplus value relative to their total capital invested, not only to their wage bill. A century ago Eugen von Böhm-Bawerk claimed that Marx’s account was inconsistent: either goods changed at their values as Marx claimed in Volume 1, or at their cost price as Marx claimed in Volume 3.

Marx scholars like Isaak Illich Rubin and Roman Rosdolsky dealt with the matter, showing that the theory was a theory of total production, not, in the first instance, of prices. (Those scandalized that the account of value in the first book is different from the outline of cost price in the third have not noticed that Marx’s argument is developing throughout, even in the first volume, from value, to exchange value, to price and so on.) A school of “neo-Ricardian” economists also tried to solve the alleged inconsistency, using a “single-system interpretation” (SSI, “single system” meaning that there was no “transformation” of values into prices, but that all values are already prices). Nowadays very few people are interested in the transformation problem, still fewer in the rival resolutions of it by the long-defunct school of “neo-Ricardians” or those few still defending Marx’s honor. But Gugliemo Carchedi, Alan Freeman, and Andrew Kliman fight on with their own Temporal Single System Interpretation. Not important in itself, there is one outcome that distorts Kliman’s account of Marx’s theory of capital accumulation.

For the adherents of the TSSI, in their lifelong struggle against the errors of the SSI, it was important to show that inputs are not equal to outputs (as the SSI-faction claim). Kliman goes to great lengths to show that the substantial difference between inputs and outputs comes about because of the depreciation of capital goods, and that the value of the goods that make up the production process changes over time in the production process (hence “temporal single system interpretation”).

Kliman’s close focus on the depreciation of capital goods (machinery, raw materials) side-lines the rather more important difference in the value of inputs and outputs in Marx’s system, namely, the difference between the price that the capitalist pays the worker for his labor-power and the value that the labor creates.[7] “Moneybags must be so lucky”, writes Marx, to find a commodity that creates more value than it has. The commodity is labor-power, which costs less than it produces. The laborer’s wages are less than the output of the production process. For 150 years Marxists have argued that this, the exploitation of labor, was the dynamic basis of capitalist society. For reasons best known to him, Andrew Kliman demotes exploitation as the main difference in the value of inputs and outputs in favor of what is really a secondary effect of the accumulation process, the depreciation of capital.

Thinking that perhaps this was a specific technical debate that Kliman had got wrapped up in in his theoretical book, I check the more general account in The Failure of Capitalist Production. But there, too, is the depreciation of capital foregrounded while exploitation is considered of secondary importance. Kliman thinks that the question of the survival of capitalism will be decided by whether capital is depreciated or not. (That is not wholly without meaning. The depreciation of capital was highlighted by Henryk Grossmann as one of the “counter-acting tendencies” to declining profitability, as when bankrupted businesses write off their inventories in a crisis and these go at fire-sale prices.)

Kliman claims that the exploitation of labor, on the other hand, tells us very little about the dynamic of capitalist development, since it has not changed very much, and does not seem to be the foundation of capitalist growth in his account; and in any event, he says, increasing exploitation is of limited use since the clock cannot include more than 24 hours. Kliman goes on to say that an “increase in productivity does not cause more new value to be created.” (16) That increased productivity, by cheapening the means of subsistence, makes it possible for capitalists to pay their workers less and increase exploitation, which was so central to Marx’s theory, does not feature in Kliman’s.

Kliman says that the capital depreciation in the 1930s and the war years was the basis of the post-war boom. Certainly it was the second most important factor. But he misses out the first most important factor, which was the great increase in exploitation both through over-working people and rationing their consumption. A focus on historical change is a good thing, indeed he could do with more of it, but in Kliman’s theory rather too much change is attributed to falling asset prices, and not enough to the relations between capital and labor.

Kliman uses the TSSI interpretation to massage the statistics on the rate of profit. He claims that what is important is not the cost it would take to replace the capitalists’ assets but their historical cost. But capitalists use different ways of reckoning their investments in different circumstances; sometimes one way, sometimes another. One cannot help but think that the real importance of the adjustment that Kliman makes to the rate of profit is to make it look smaller, so seeming to prove his claim that there was no recovery of growth in the nineties.

The organic composition of capital

Kliman says that falling profit rates since the 1970s are coeval with falling investment rates since the 1970s. And he says that this confirms Marx’s argument. But in fact it turns Marx’s argument on its head. Marx sees falling profit rates arising out of the overaccumulation of capital, a rising organic composition of capital. If investment rates are low, then there would seem to be no sharp rise in the organic composition of capital.

The period that Kliman wants to prove did not happen—the long period of growth—was characterized by the International Monetary Fund as a period of job-rich growth, and it was, generally, labor intensive, more than it was capital intensive—both in the US, and worldwide. Whatever the explanation of the 2008 crisis, it would be difficult to account for it by a sharply climbing organic composition of capital in the preceding period.

In his chapter on why profit rates fell, Kliman says that the organic composition of capital increased at a rate of 1.7 per cent per year, and that this was responsible for most of the fall in the rate of profit.

But in his calculation of the organic composition of capital he makes an undue distinction between the value composition of capital and the organic composition of capital. Marx says that the value composition of capital is determined by the technical composition of capital and mirrors it (though not absolutely, because of changes in the value of constant capital).

But what Kliman calls the “nominal value composition of capital” is the ratio of c to v, and it is not right to adapt it to take into account the rising technical composition of capital, as he seems to, because it ought anyway to reflect the technical composition of capital, without being tinkered with. The nominal value composition of capital rises less than 0.1 per cent per year between 1961 and 1999 on Kliman’s calculations—which must surely be wrong. (p 133)

It is a good question to ask why capitalism today is so cautious about economic growth. But Kliman presents an over-objectified account of the limits, which unfortunately chimes with the dominant, anti-growth outlook of today. The exhaustion of first the Keynesian strategy of boosting demand (in the 1970s) and then later of the supply-side strategy of liberalization has indeed left capitalists at a loss about what to do next. But Kliman’s mechanical account of objective barriers to growth is not really a challenge to the contemporary elite outlook, which often emphasizes supposedly necessary limits to growth—whether natural or moral—as a way of excusing its own failures.

It would be more fruitful to investigate the subjective limits to capital accumulation—namely the capitalist class’ retreat from innovation and development. To do so would be to step outside of the formal framework of Marx’s capital, but surely be closer to his underlying method which was to understand capital as a social relation, not as a thing. That would demand taking the historical changes in the class struggle more seriously, and investigating the current torpor of the capitalist class in its own terms.|P

[1]. As, for example, Donald L. Barlett and James B. Steel, America, What Went Wrong?, (Kansas City, Mo.: Andrews and McMeel, 1992); William Greider, Who Will Tell the People, (New York, NY: Simon & Schuster, 1992); Allan Bloom, The Closing of the American Mind, (New York, NY: Simon & Schuster, 1987); Emmanuel Todd, After the Empire, (New York, NY: Columbia University Press, 2003). American decline is a genre that goes back to Frederick Jackson Turner’s, The Frontier in American History, 1893.

[2]. See Daniel Ben-Ami, Cowardly Capitalism, (John Wiley & Sons, 2001).

[3]. See Ben Hunt, The Timid Corporation, (John Wiley & Sons, 2003).

[4]. Paul Mattick, ‘Value Theory and Capital Accumulation’, Science and Society, Winter 1959, Vol XXIII, No 1, 33.

[5]. Karl Marx, Capital, Volume III, Part 3, Chapter 13, see https://www.marxists.org/archive/marx/works/1894-c3/ch13.htm

[6]. See http://www.marxists.org/archive/dunayevskaya/works/1947/decline-profit.htm

[7]. Andrew Kliman, Reclaiming Marx’s ‘Capital’, (Plymouth, UK: Lexington Books, 2007), 94.